candi solar B.V Issue 5: South Africa - 5.75% Bond

£150,000 | 121 | 0 |

241 KWp

241 KWp

Candi will use funds from this raise to install approximately 241 KWp capacity of solar panels. 1 SME

1 SME

Funds from this raise will provide one small and medium sized enterprise (SME) with clean and affordable energy.

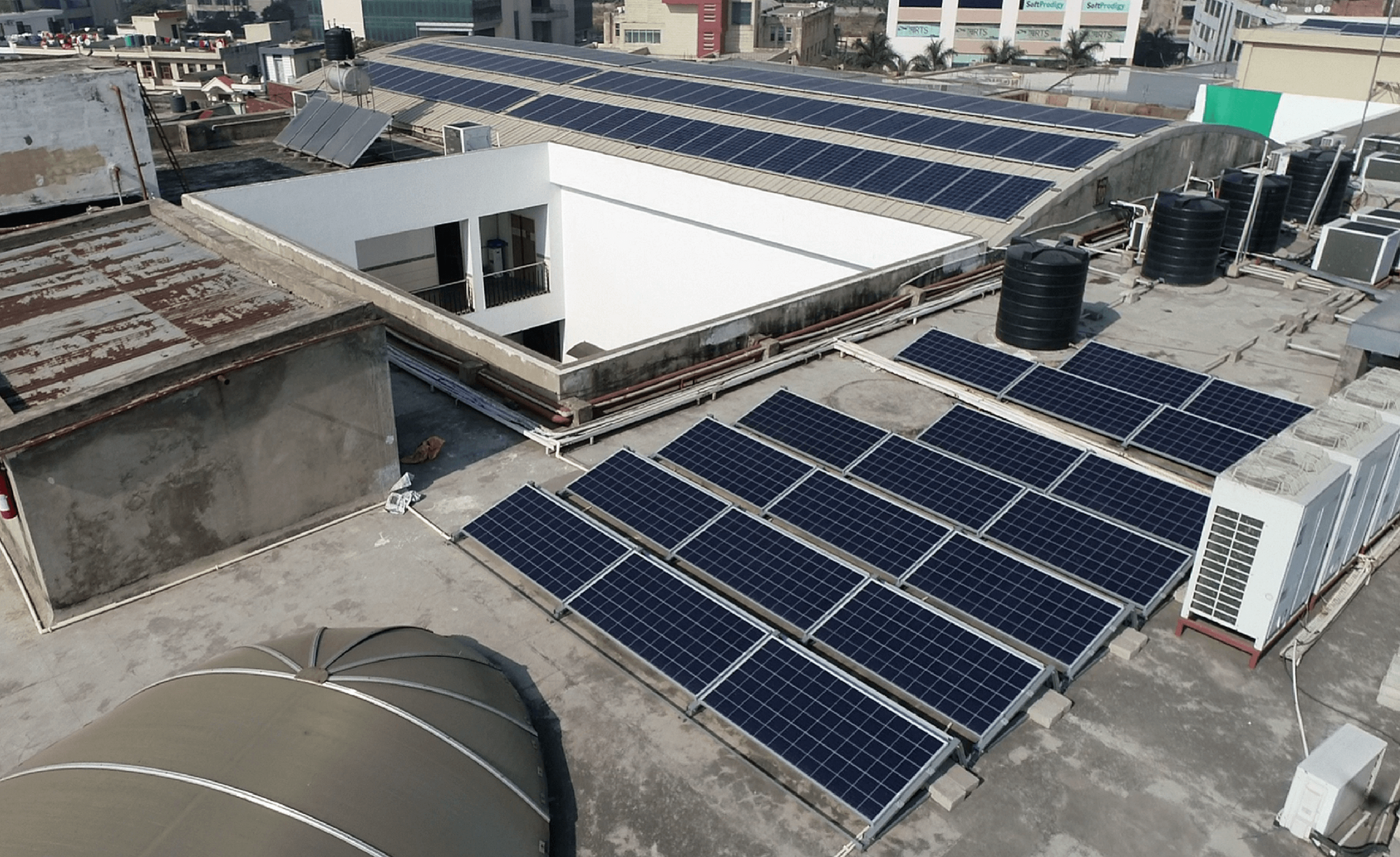

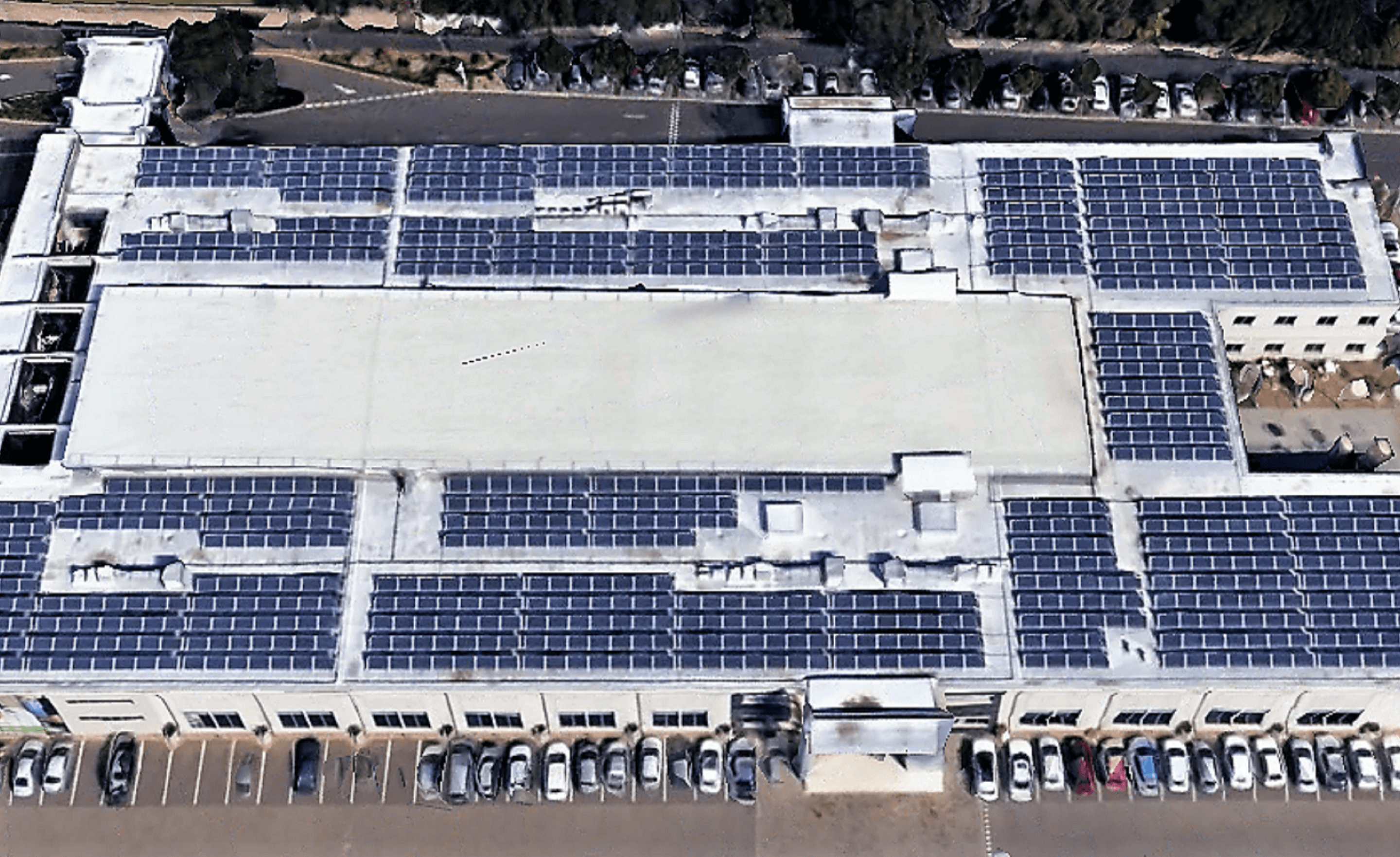

Founded in January 2018, candi is a dedicated rooftop solar installer, financier and operator for underserved small and medium sized businesses (SMEs) in South Africa and India.

It brings together international capital, through its Swiss-based parent, and local expertise in order to serve this underserved sector. In doing so candi aims to reduce carbon emissions, create jobs, increase energy access and save money for businesses, thereby releasing capital for more productive use in the economy.

About candi solar B.V

Key Product Information

Issuer: Candi solar B.V.

Issuing Country: Netherlands

Investment target: £150,000

Minimum investment: £50

Maximum investment: No maximum

Maturity: 18 months

Expected interest rate: 5.75% per annum

Withholding tax rate: 0% (applicable to UK residents who do not invest within an IF ISA)

Interest payment frequency: 6 monthly

Capital repayment: 6 monthly (from 12 months onwards*)

Financial instrument: Promissory note / secured interest bearing bond

Security: Secured (For more information regarding security, see page 27 of the Offer Document)

*For the first 12 months after the Issue Date, a "Grace Period" applies during which no capital repayments occur. The first capital repayment will take place 12 months after the Issue Date. Please refer to the amortization schedule found on Page 16 of the offer document.

Key Risks

This is a bond issued by a single company (rather than a savings product) and therefore it is recommended that you are careful with the amount you invest.

You must read the investment memorandum (provided below) where a full statement of risks is presented.

Documents

Candi solar in the media

Candi solar B.V. is one of the pioneering solar companies supported by the Energise Africa initiative, a joint venture between Lendahand and Ethex.

What the project investment will enable

With the funds from this raise, candi will finance, procure and install one tailor made solar infrastructure project of upto 241KWp solar capacity into lease with an SME in South Africa.

Since its incorporation, candi has built a portfolio of more than 30MW and has a predicted pipeline of a further 100MW of installations across South Africa and India. As well as installing these systems for their clients, candi also provides technical advice and operation and maintenance support, providing their clients with a holistic solution to their systems. All the company’s equipment is certified and sourced from tier 1 suppliers across the value chain, including Jinko Solar, Trina Solar and SMA Solar Technology.

Examples of some of the SMEs who are clients of candi include food manufacturers, media outlets as well as schools and universities. These clients are typically situated in areas with high power tariffs, dense industrial clusters, and where there is an unreliable power grid. Access to client's own electricity supply greatly reduces the risk of black outs and candi's multiple contractual structures means clients can choose based on their own needs and financial position.

candi solar B.V

candi offers a fully financed rooftop solar solution to underserved SMEs in South Africa, allowing clients to immediately cut their electricity costs, reduce their reliance on grid and diesel power, and eventually own the system themselves.

This investment will empower the SMEs through a fully financed rooftop solar solution, cutting their operating costs and allow them to inject the savings back into their operations e.g. to create jobs, finance schoolbooks & playground, purchase IT equipment and make refurbishments.

Social and environmental impact

The installation of solar plants for small and medium-sized enterprises (SMEs) has shown to have both a significant impact on the companies and the environment. To date, candi has contracted and/or commissioned approximately 30MW in projects across 65 different sites (12.3MW in delivery).

Social Impact

The positive impact of addressing this market gap is immense. The social impact that candi has made to-date is:

65

tailor made solar infrastructure projects installed

30MW

total installed/commissioned capacity to date

49

full time employees at candi

Environmental impact

The environmental impact of installing the full 241kWp capacity from this raise will be:

1

new SME utilising clean energy

344 tonnes

reduction of CO2 each year per system

~8,616tonnes

total CO2 emissions offset over 25 years