RAISING HANDS. RAISING FUNDS. RAISING THE BAR.

We help sustainable businesses from emerging economies get affordable, flexible funding to bridge the finance gap and grow.

Need a hand? Fill in the form and we’ll get started.

A LITTLE HELP FROM OUR FRIENDS

Thanks to our community of over 5,000+ individual investors, we have raised over £43 million and made £29.5 million in repayments. That’s an amazing amount of people-powered finance, which has provided more than 750,000 people across 14 African countries with access to affordable and life changing solar energy. We have also supported over 8,000 small and micro-sized enterprises.

Known for funding solar business across sub-Saharan Africa, we’re now widening our net. That means we’re offering our support and services to other sustainable businesses in emerging markets. So more great ideas can grow.

If this is music to your ears then get in touch.

PLAYING OUR PART

We’re proud of our track record of helping impactful businesses so far. Learn about how we work through these examples of success. Get an idea of what to expect and how our business model can support your growth.

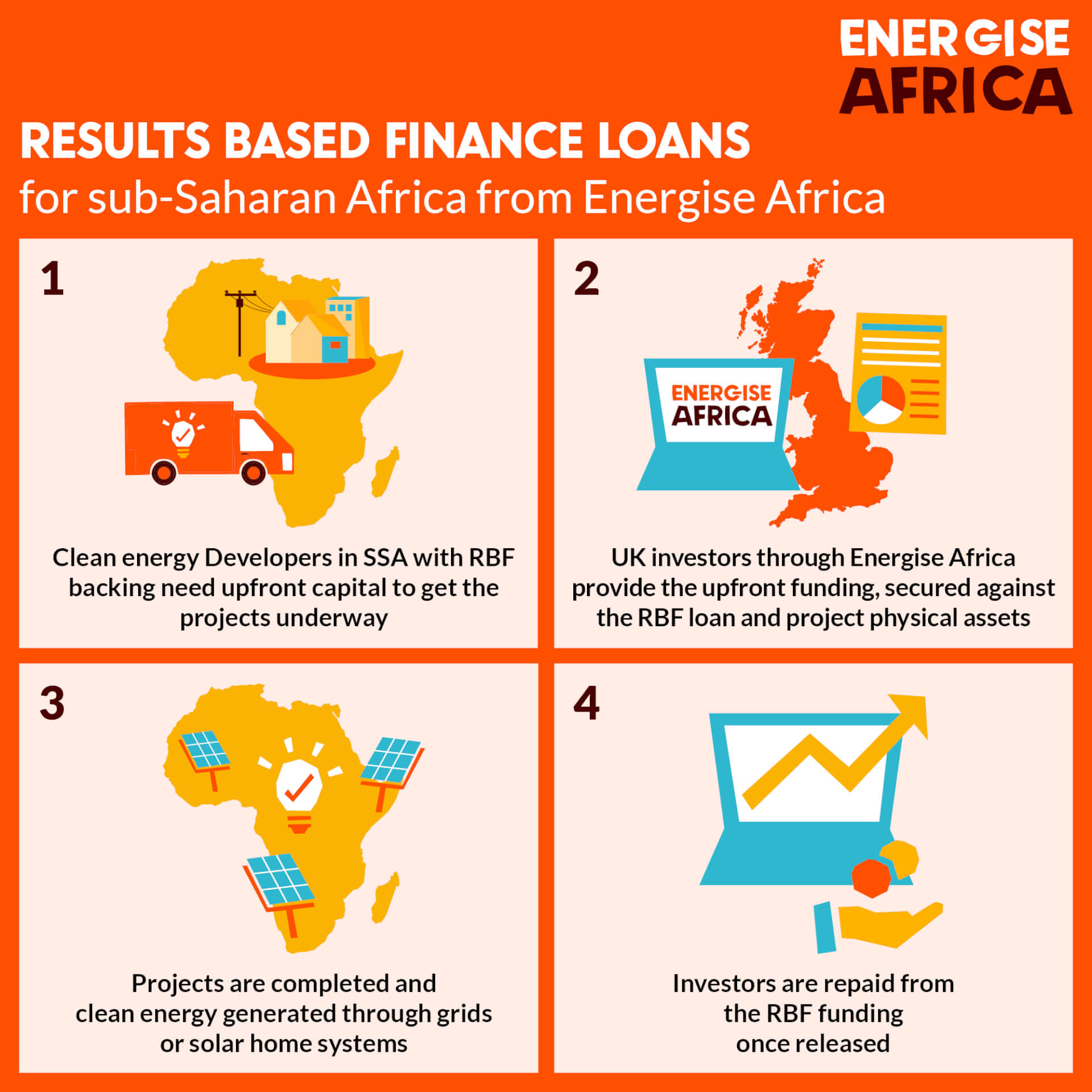

SMART FUNDING WITH BLENDED FINANCE.

If you’re an institution interested in match funding or offering other support then drop us an email at help@energiseafrica.com.

Match funding. Co-investment. Partial guarantees. We use smart ways to build trust with investors through institutional partners who provide financial backing. You can learn more on our partnerships page.

Do you want to be our next blended finance funding partner?

Please get in touch if you are an organisation offering match funding, co-investment and/or partial guarantees for sustainable businesses and would like to work with us.

FAQs

View all FAQsWe’re all about providing flexible, affordable finance to impact driven companies working in emerging economies. We know that pioneering companies come in many shapes and sizes, from start-ups to established organisations looking to expand.

From the first conversation with the investments team to offers going live on the platform typically takes 2 – 5 months and getting a favourable decision ultimately depends on your financing needs, your credit profile and how the investment opportunity is structured.