Solarise Africa Issue 3 - 6.75% Bond

£550,000 | 397 | 0 |

750 kWp

750 kWp

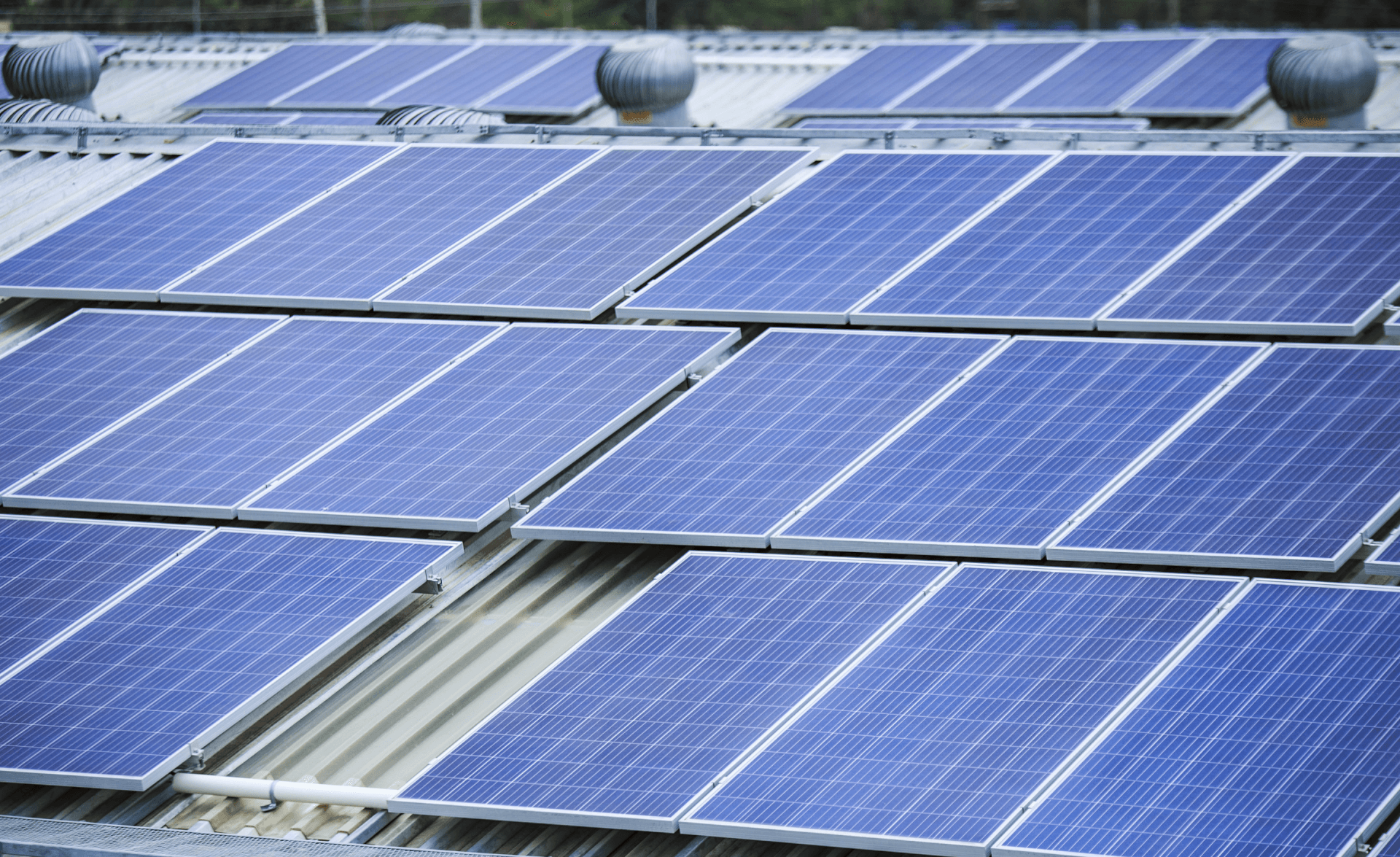

With borrowing of £550,000, Solarise Africa will be able to install and lease approximately 750kWp capacity.

2 customers

2 customers

Funds from this raise will provide up to 2 commercial and industrial (C&I) customers with clean and affordable energy.

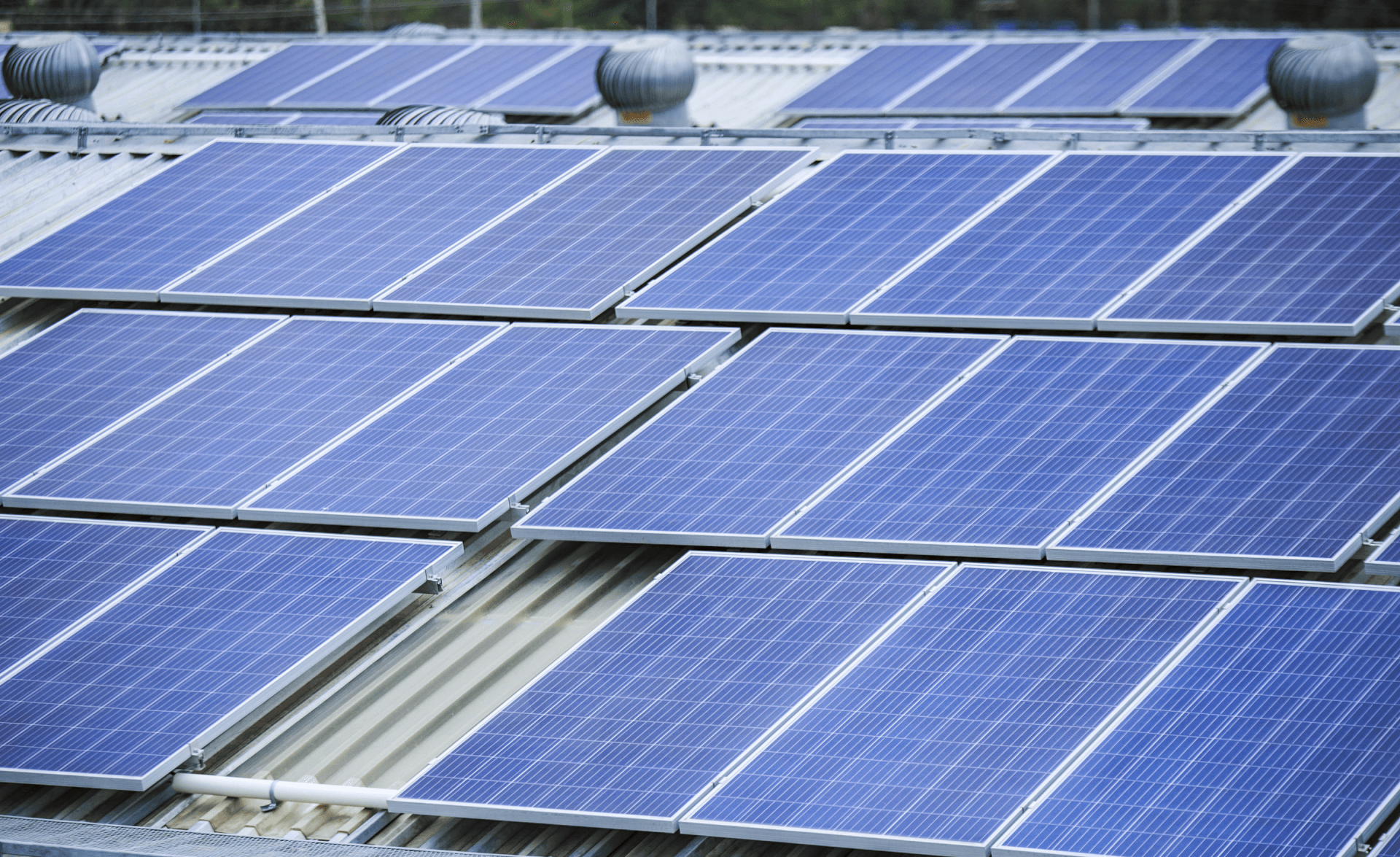

Solarise Africa is a pan-African Energy-as-a-Service leasing company. Through smart financing solutions, the Company unlocks possibilities and empowers their partners to thrive and actively drive Africa’s progress.

Together with their partners, Solarise Africa offer innovative full-service solutions that cover designing, building, financing, and maintaining solar installations.

About Solarise Africa

Key product information

Issuer: Holdco Solarise Africa Ltd

Issuing Country: Mauritius

Investment target: £550,000

Minimum investment: £50

Maximum investment: No maximum

Maturity: 12 months

Expected interest rate: 6.75% per annum

Withholding tax rate: 0% (applicable to UK residents who do not invest within an IF ISA)

Interest payment frequency: 6 monthly

Notional repayment: 6 monthly (from 12 months onwards)*

Financial instrument: Interest bearing bond

Security: Secured (For more information regarding security, see page 23 of the Offer Document)

* For the first 12 months after the Issue Date, a "Grace Period" applies during which no capital repayments occur. The first and only capital repayment will take place 12 months after the Issue Date. Please refer to the amortization schedule found on Page 26 of the offer document.

Key risks

This is a bond issued by a single company (rather than a savings product) and therefore it is recommended that you are careful with the amount you invest.

You must read the investment memorandum (provided below) where a full statement of risks is presented.

Documents

Solarise Africa in the media

Solarise Africa is one of the pioneering solar companies supported by the Energise Africa initiative, a joint venture between Lendahand and Ethex.

What the project investment will enable

Solarise Africa will use funds from this raise to provide 2 new customers in Kenya with renewable energy, totalling approximately 750kWp.

Solarise Africa focuses its business model on the Commercial & Industrial (C&I) sectors in countries of operation within Sub-Saharan Africa with each project installation generating a positive social impact.

In addition to jobs created in the solar industry, the companies that install solar experience lower energy bills, which in turn can translate into business expansion and further jobs creation. Most Sub-Saharan African countries also experience power outages in varying degrees, as ageing fossil fuel infrastructure fails and needs additional maintenance. The use of solar for power generation reduces the impact of these outages and in turn produces a positive economic impact for countries.

Solarise Africa

Solarise Africa is looking to raise £550,000 from this bond issue as working capital to help purchase and install 2 solar units, totalling 750kWp capacity for C&I customers in Kenya.

To date, Solarise Africa has installed approximately 2.56MW which in the last 6 months has produced 1,742MWhs of clean energy and saved approximately 1,054 tonnes of CO2. With offices in Kenya, South Africa, Uganda and Rwanda, Solarise hopes by 2026 to have a portfolio of renewable capacity of $55M stretching across Africa.

Social and environmental impact

The installation of solar plants for commercial and industrial (C&I) companies has shown to have both a significant impact on the companies and the environment. To date, Solarise Africa has commissioned over 2.56MW in projects and has 11 solar units installed.

Social Impact

The positive impact of addressing this market gap is immense. The social impact that Solarise Africa will make from this raise is:

2

new commercial and industrial (C&I) customers with clean and affordable energy

750kWp

of solar capacity installed

30%

reduction in electricity costs from the first month

Environmental impact

The environmental impact of the 11 solar power installations already installed by Solarise Africa over the last 6 months is as follows:

2.56MW

total capacity operational

1,721 MWh

of clean renewable electricity generated

1,054tonnes

of CO2 emissions avoided